Hydrogen is a key part of Europe’s decarbonisation programme, driven through significant funding and subsidy mechanisms at a regional and country level, such as the Important Projects of Common Interest (IPCEI) and the EU Innovation Fund with €18.9bn and €4.8bn allocated respectively. Some countries have also developed domestic support mechanisms, such as the UK’s CfD-based Hydrogen Allocation Round (HAR) and Germany’s flagship funding scheme H2Global.

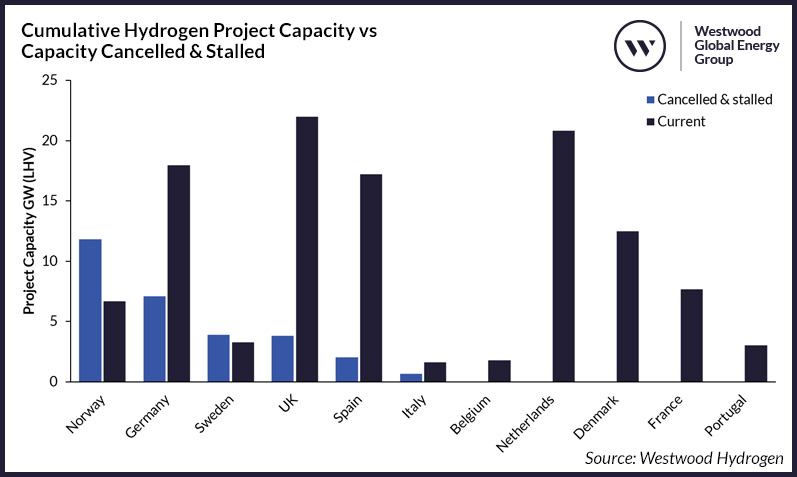

However, the industry has experienced growing pains in the past year, culminating in the cancellation and stalling of several projects with a fifth of projects lost according to an analysis by the Westwood Global Energy Group that has identified 23 projects in the European pipeline that have been classed as cancelled or stalled across 11 major European countries that make up the majority of the Hydrogen opportunity. The total capacity lost by these projects is 29.2GW or 20.3 per cent of the pipeline.

Across these countries the amount of capacity ‘lost’ varies greatly, with the Netherlands unaffected through to Norway, which has lost more capacity than it has remaining in its pipeline, 11.8GW and 6.7GW respectively.

Westwood attributes the high costs and economic challenges as the prime reason for the drag, including lack of access to funding, not just in monetary terms but also in the prolonged and complex process. Across the UK and Germany this has inhibited over 8GW of projects developing, one of which being the huge 1.8GW (LHV) DepHYnus project that was unable to win funding in the Hydrogen Allocation Round (HAR) within the UK. The developers stated that the project was cancelled as a result. This is one of multiple symptoms of the HAR round, with developers finding the process long and confusing and the CfD mechanism being much more complex than its offshore wind counterpart. Additionally, some developers selected in the HAR processes have pulled out, citing the challenges around timelines. This means that despite projects being deemed worthy of funding they are still not able to proceed.

Another common challenge faced is the lack of demand, with 11 per cent of projects (and 9 per cent of capacity) lost, citing this as the reason for shelving their projects. The inability to secure demand is a key reason projects are unable to secure any finance.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories