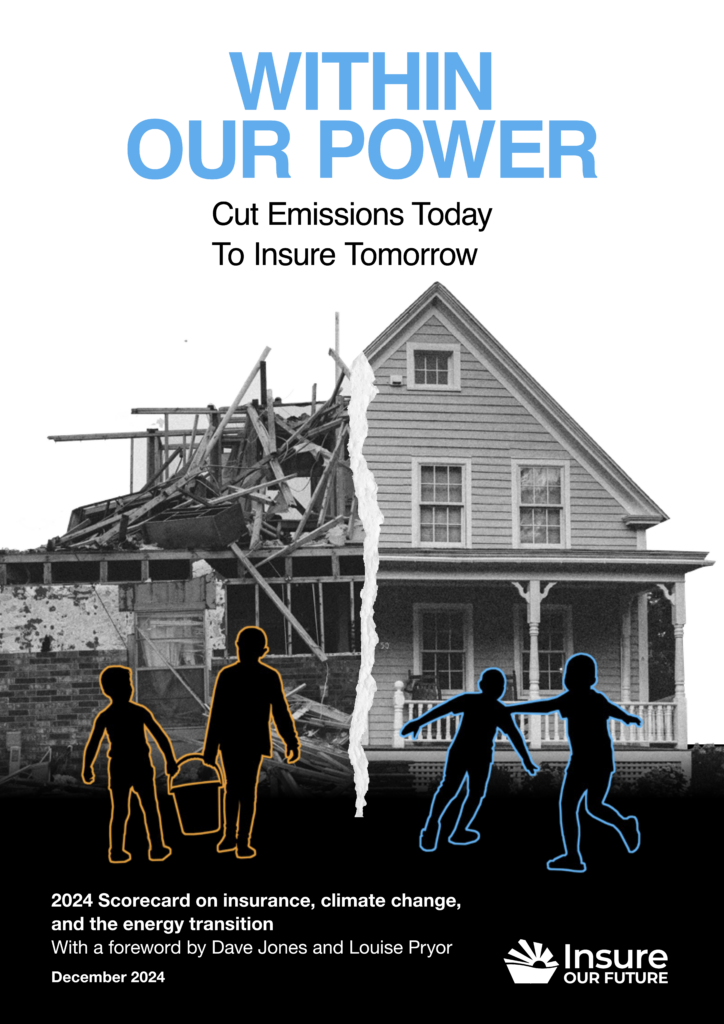

Insure Our Future’s report Within Our Power analysis of 28 major global property and casualty insurers found that their estimated share of climate-attributed losses ($10.6bn) almost matched the $11.3bn in direct premiums they underwrote for commercial fossil fuel clients in 2023.

For more than half of the insurers; including Allianz, AXA and Zurich; losses actually exceeded the coal, oil, and gas premiums, and overall climate change has accounted for an estimated $600bn of global insured weather losses over the last two decades, rising from 31 per cent to 38 per cent of total over the last decade on average.

Some insurers are acting, with Italian insurer Generali setting a new bar this October by adopting the first fossil fuel restriction policy that covers the entire oil and gas value chain and includes in its scope new methane LNG projects that threaten climate targets.

However, the analysis found that the industry as a whole has stalled on effective climate action, and the total commercial fossil fuel insurance market grew marginally in the last two years. Total renewable energy insurance premiums are still under 30 per cent the size of the fossil fuel insurance market ($6.5bn compared to $22bn) creating a potential insurance bottleneck for up to $10tr of climate transition investments by 2030.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories