Since 2019, global EV sales have rapidly grown from 1.6 million to 9.6 million cars in 2023, or around 15 per cent of the global market.

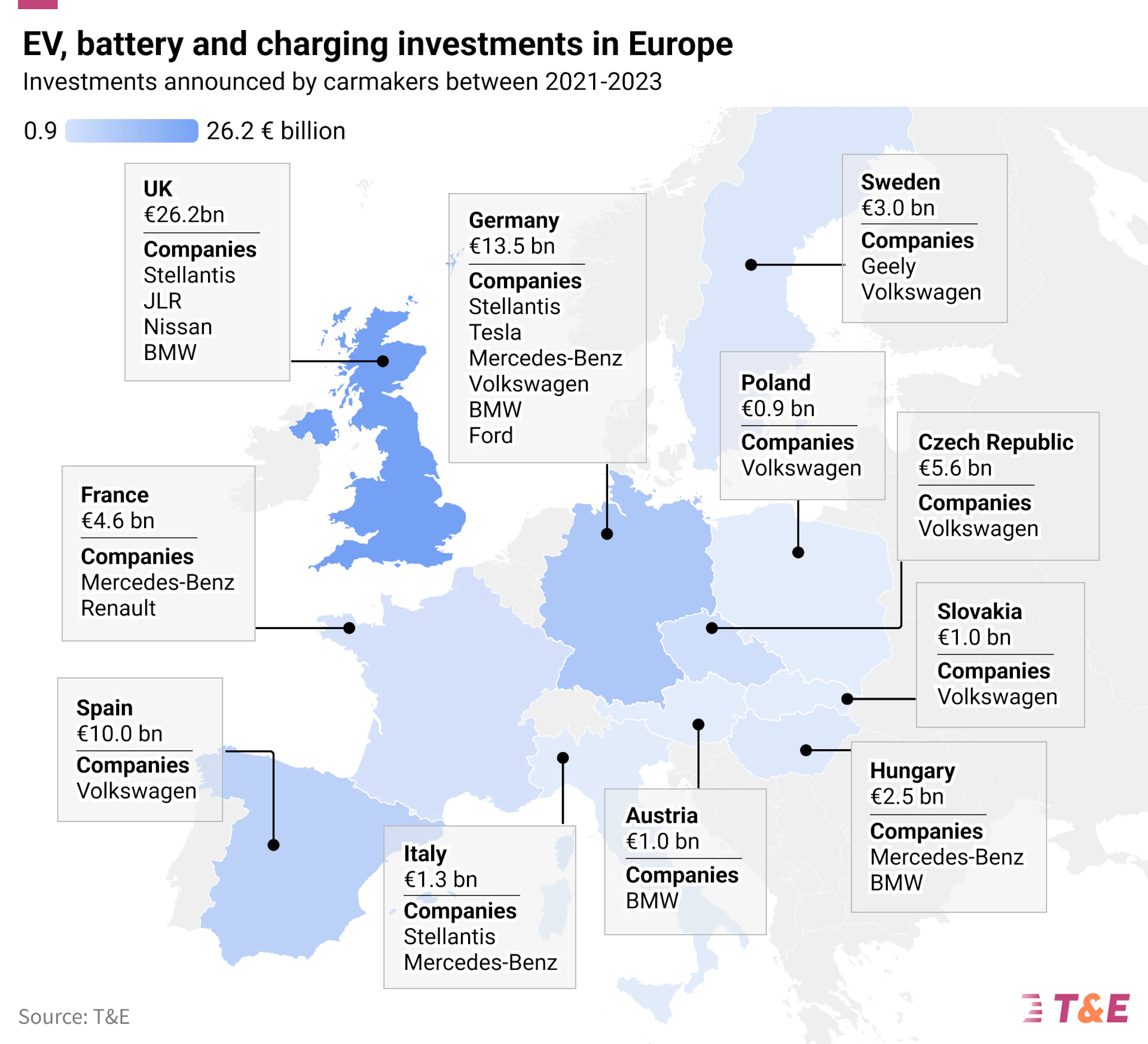

Likewise, the investments in EVs, battery cells and charging by the 19 carmakers analysed by Transport & Environment (T&E) in a recent study have increased almost six-fold between 2021 and 2023, reaching €150bn in 2023 and an even greater total of €265bn was announced during this period.

Of these 19 carmakers, European carmakers were responsible for the largest share of announcements (34 per cent), followed by Chinese (20 per cent) and South Korean (18 per cent). Sao far, so good, but at the same time that European carmakers have invested the most in electrification, North America, a smaller global car producer, has been the biggest destination for actual investments, securing 37 per cent compared to Europe’s 26 per cent.

North America is the only region which has a large share of investments from non-domestic carmakers including European, Japanese and South Korean carmakers, lured by the generous local manufacturing subsidies granted by the Inflation Reduction Act for EV and battery production.

In contrast the majority of investments in Europe (80 per cent) are by European carmakers, with the remaining majority coming from Tesla, Geely, Nissan and Ford.

Of the carmakers which have invested in Europe, only six (BMW, JLR, Renault, Mercedes, Nissan and VW) have directed more than 50 per cent of their investments to Europe.

The largest beneficiary was the UK, predominantly due to large investments by JLR accounting for 84 per cent EV investments in the UK. Meanwhile Fiat-Chrysler owner Stellantis has directed just 10 per cent of announced investments to Europe, instead locating 74 per cent in North America.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories