Meeting global goals will require a substantial increase in capital investment in the energy sector. But who is making investments in energy today, and who is financing these investments?

Based on first-of-its-kind analysis in the 2024 edition of the IEA’s flagship World Energy Investment report, these important questions have been scrutinised and the IEA has identified key trends over the past decade based on this data.

Currently, more than three-quarters of global energy investment is financed by commercial sources. Around 25 per cent comes from public finance and 1 per cent from development finance institutions (DFIs).

In clean power, where upfront costs are high and margins are lower, the share of debt financing is currently around 50 per cent. Meanwhile, debt financing in end-use sectors, including industry, buildings and transportation, is close to the 45 per cent average. In contrast, the debt share is low at around 20 per cent for clean fuels and other emerging technologies. These nascent technologies are associated with higher risks, so developers tend to obtain financing through venture capital rather than debt markets.

Given high energy prices following the pandemic and Russia’s invasion of Ukraine, fossil fuel companies have been in a position to reduce their debt levels in recent years. They now have leverage ratios of 40 per cent on average, below the typical 45 per cent across the whole energy sector. Consequently, they have been able to finance investments primarily through retained earnings, while returning cash to shareholders via generous buybacks and record dividends.

National oil companies (NOCs) rely less on debt spending than their peers, tapping it for around 35 per cent of total investment. Since NOCs typically generate sufficient income from upstream assets to cover their capital requirements, they tend to use debt either to finance a rapid increase in production or to grow new business areas, though their strategic and financial autonomy is shaped by their host governments.

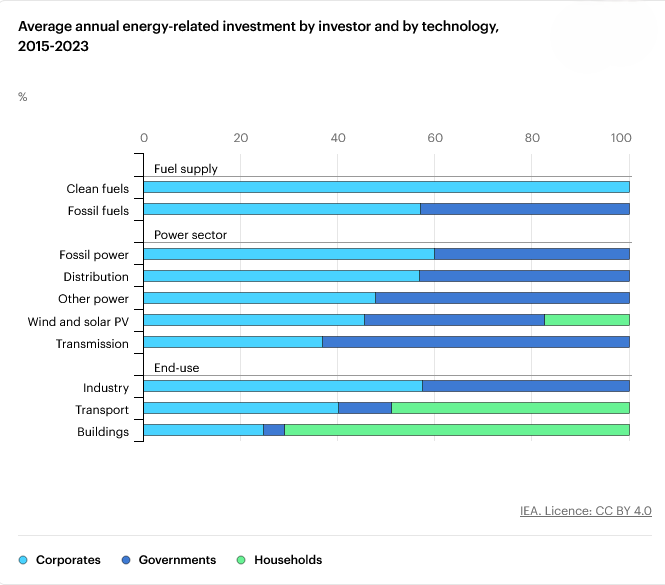

The share of investment by households has doubled since 2015 as clean energy transitions have accelerated. It now stands near 18 per cent following recent spending from higher-income households on rooftop solar, energy efficiency improvements, heat pumps and EVs. Some 10 per cent of this investment is supported by governments in the form of grants or tax incentives, especially in advanced economies.

The growing role of households is evident in recent data. In 2023, the share of investment by households relative to total energy spending reached 29 per cent in Japan and Korea and 27 per cent in Europe, followed by 11 per cent in North America. Spending on improving energy efficiency in buildings accounted for 50 per cent of all energy-related investments in Japan, Korea and Europe last year.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories